Photo Credit: Freedomz / Shutterstock

Home buying during the pandemic has been a story of bidding wars, housing shortages, and rapidly increasing home prices. Despite this, record low interest rates encouraged millions of buyers to take out loans for new homes. According to loan-level mortgage data from the Home Mortgage Disclosure Act (HMDA), 86.3% of 2020 applicants were approved for home purchase mortgages, with a median loan amount of $235,000.

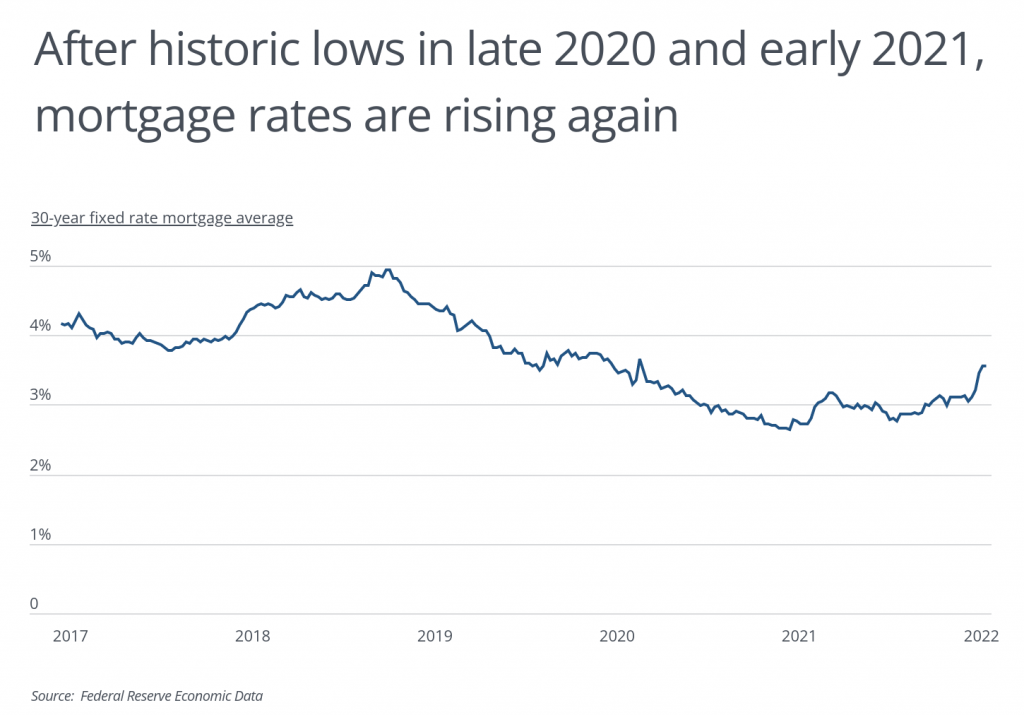

In the second half of 2020, 30-year fixed mortgage rates fell below 3% for the first time in history and then continued to fall. Due in part to emergency actions by the Federal Reserve, 30-year rates dipped as low as 2.66% at the end of 2020. Total mortgage applications—including home purchases, home improvements, and refinancing—soared in response, increasing from 17.5 million in 2019 to 25.6 million in 2020, according to HMDA data. Conventional home purchase loan applications numbered 5.8 million in 2020, accounting for 23% of all applications. In the last few months, rates have begun to rise again, which will likely put downward pressure on both applications and home prices.

While conventional home purchase mortgage applications for single family homes increased by 6% from 2019 to 2020, to 5.8 million, multifamily loan applications declined, from 30,462 in 2019 to 25,654 in 2020. This trend reflects a growing preference for single family housing amid the COVID-19 pandemic.

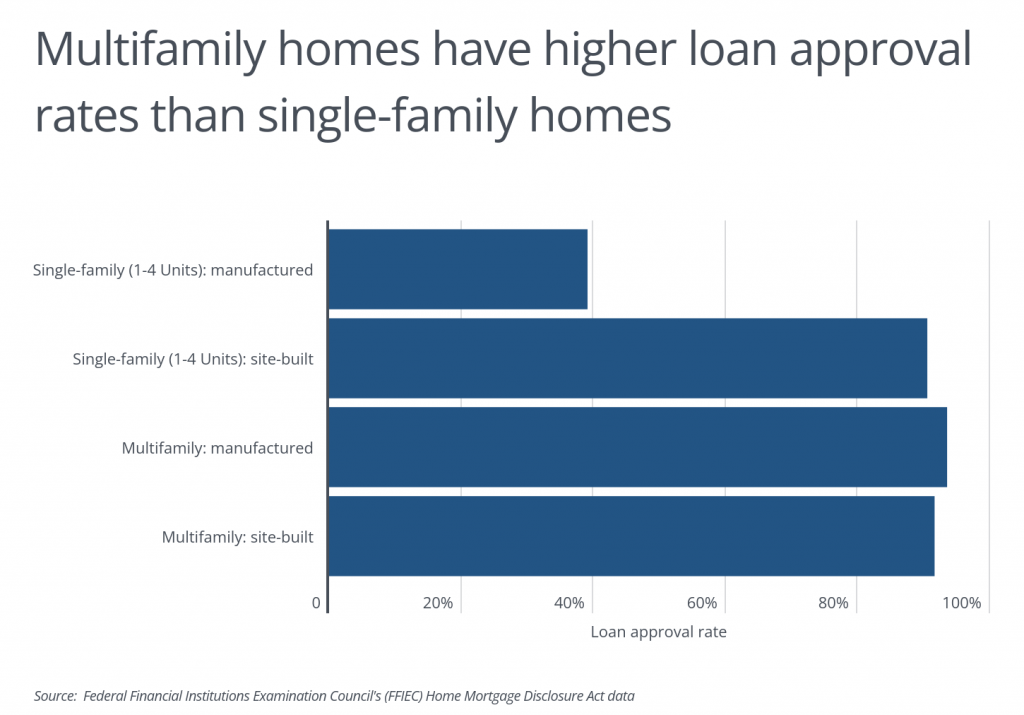

Although single family loan applications are far more common, the mortgage approval rates for multifamily homes, which are more likely to be owned by investors, are higher overall. The approval rate for site-built multifamily homes was 91.6% in 2020, slightly higher than the 90.5% approval rate for site-built single family homes. With regards to manufactured housing, while loans for multifamily manufactured homes have similar approval rates as those for site-built homes, a majority of single family manufactured mortgages are denied. These applicants tend to be lower income, living in rural areas, and many do not own the underlying land.

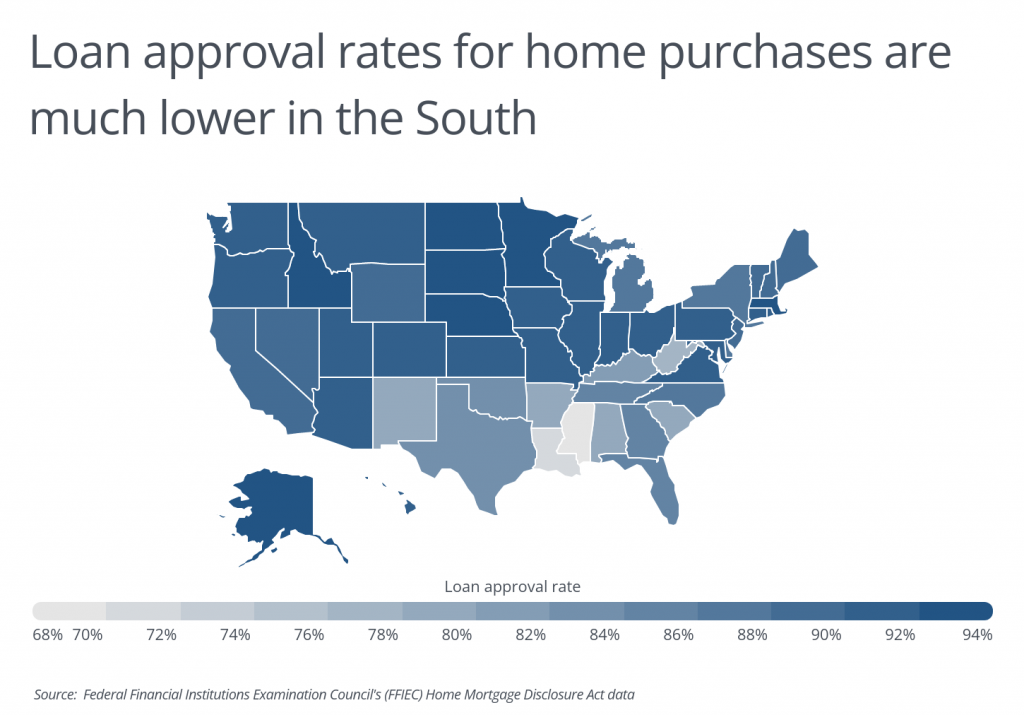

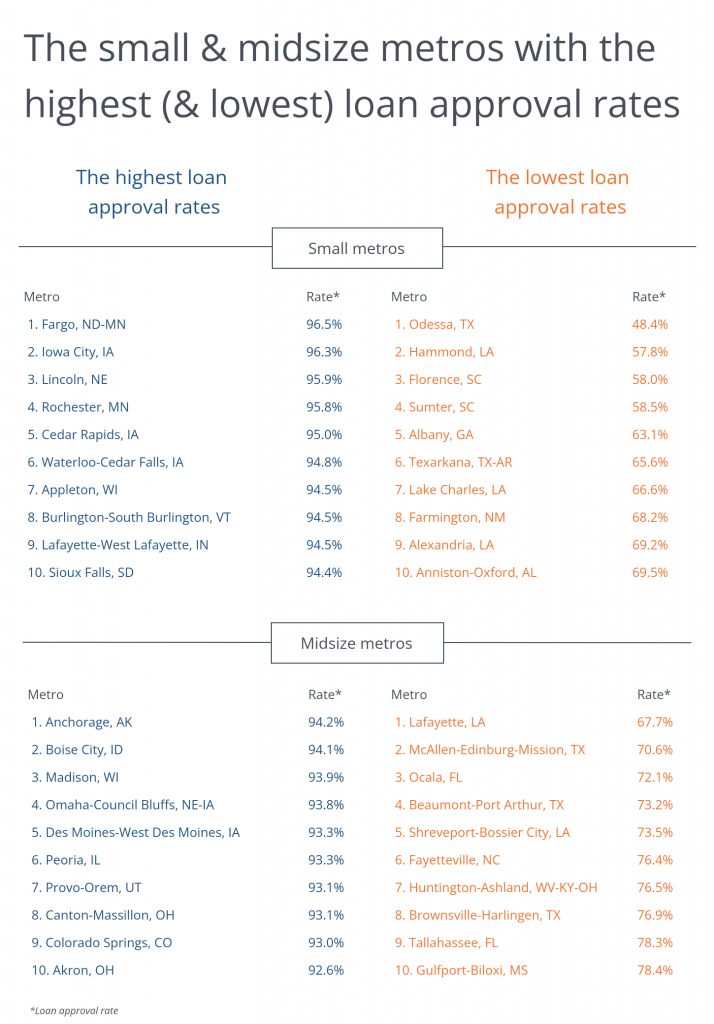

Varying loan approval rates across the country are due to several factors, including differences in demographics and socioeconomic status. At the regional level, home purchase loan approval rates in the Great Plains states, Midwest, and Northeast tend to be higher while approval rates in the South are lower. With a loan approval rate of 93.5%, Nebraska claims the highest approval rate in the U.S. The median loan amount for Nebraska loans was $185,000 in 2020, lower than the national median of $235,000, and the median loan-to-value (LTV) ratio was 86%, higher than the national median LTV of 82%. Conversely, Mississippi had the lowest home purchase loan approval rate in the country at just 68.8%. The median loan amount for Mississippi mortgage loans was $105,000, and the median LTV was 89.3%. In general, locations with lower loan approval rates were also subject to higher interest rates for the mortgages that were ultimately approved.

To determine the metropolitan areas with the highest loan approval rates, researchers at Stessa analyzed the latest data from the HDMA. The researchers ranked metros according to the loan approval rate for conventional home purchase loans. Researchers also calculated the median loan amount, the median loan-to-value ratio, and the median interest rate. To improve relevance, only metropolitan areas with at least 100,000 people were included in the analysis.

Here are the metros with the highest loan approval rates.

Large Metros With the Highest Loan Approval Rates

Photo Credit: Checubus / Shutterstock

1. Minneapolis-St. Paul-Bloomington, MN-WI

- Loan approval rate: 93.7%

- Median loan amount: $265,000

- Median loan-to-value ratio: 90.0%

- Median interest rate: 3.1%

Photo Credit: f11photo / Shutterstock

2. Kansas City, MO-KS

- Loan approval rate: 93.4%

- Median loan amount: $215,000

- Median loan-to-value ratio: 86.7%

- Median interest rate: 3.1%

Photo Credit: TarnPisessith / Shutterstock

3. Rochester, NY

- Loan approval rate: 92.9%

- Median loan amount: $155,000

- Median loan-to-value ratio: 90.0%

- Median interest rate: 3.1%

Photo Credit: Travellaggio / Shutterstock

4. Boston-Cambridge-Newton, MA-NH

- Loan approval rate: 92.8%

- Median loan amount: $425,000

- Median loan-to-value ratio: 80.0%

- Median interest rate: 3.1%

Photo Credit: Agnieszka Gaul / Shutterstock

5. Columbus, OH

- Loan approval rate: 92.8%

- Median loan amount: $215,000

- Median loan-to-value ratio: 85.0%

- Median interest rate: 3.2%

Photo Credit: Roschetzky Photography / Shutterstock

6. Denver-Aurora-Lakewood, CO

- Loan approval rate: 92.7%

- Median loan amount: $375,000

- Median loan-to-value ratio: 80.0%

- Median interest rate: 3.1%

Photo Credit: A G Baxter / Shutterstock

7. Washington-Arlington-Alexandria, DC-VA-MD-WV

- Loan approval rate: 92.5%

- Median loan amount: $405,000

- Median loan-to-value ratio: 88.1%

- Median interest rate: 3.1%

Photo Credit: Sean Pavone / Shutterstock

8. Milwaukee-Waukesha, WI

- Loan approval rate: 92.5%

- Median loan amount: $215,000

- Median loan-to-value ratio: 85.0%

- Median interest rate: 3.2%

Photo Credit: Sean Pavone / Shutterstock

9. Cleveland-Elyria, OH

- Loan approval rate: 92.3%

- Median loan amount: $165,000

- Median loan-to-value ratio: 85.0%

- Median interest rate: 3.2%

Photo Credit: Sean Pavone / Shutterstock

10. Richmond, VA

- Loan approval rate: 92.3%

- Median loan amount: $245,000

- Median loan-to-value ratio: 90.0%

- Median interest rate: 3.2%

Detailed Findings & Methodology

To find the locations with the highest loan approval rates, researchers at Stessa analyzed the latest data from the Federal Financial Institutions Examination Council’s Home Mortgage Disclosure Act. The researchers ranked metros according to the mortgage loan approval rate. In the event of a tie, the metro with the larger number of mortgage loan approvals was ranked higher. Researchers also calculated the median loan amount, the median loan-to-value ratio, and the median interest rate. Only conventional home purchase mortgage applications were considered in the analysis. In the calculation of approval rates, withdrawn and incomplete applications as well as purchased loans were excluded.

To improve relevance, only metropolitan areas with at least 100,000 people were included in the analysis. Additionally, metro areas were grouped into the following cohorts based on population size:

- Small metros: 100,000–349,999

- Midsize metros: 350,000–999,999

- Large metros: 1,000,000 or more